Contact Us

Questions, comments, ideas for future content? Contact us below.

Q3 is in the books. For 6-8 weeks, we’ve talked about the increase in hiring activity. While it is too early to call it a complete comeback, the data is encouraging.

It is all about perspective. Let’s take a step back before talking about where we are today.

2023 was rough. From the peak of 2022 (May), we saw a steady 10-20% quarter-over-quarter decline. Each practice (Tech, GTM, Corporate Functions, Industrial, and Real Estate) saw slightly different trends. But none were very strong or consistent. Things bottomed out in the back half of 2023. That meant some pretty ugly numbers in Q3/Q4 of 2023.

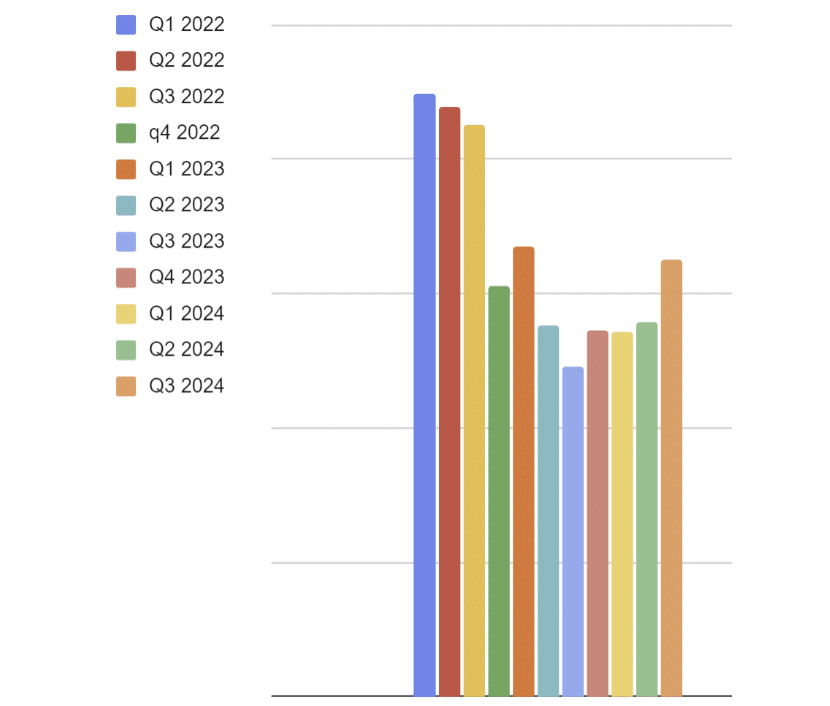

Don’t believe me? Here is a not-so-fun chart.

Those are the quarterly numbers for our tech practice (our largest team). In case you were wondering, yes, there was a bump in Q1 2023.

We’d signed a large project in Q4 2022 to do a multi-hire engagement (think 100+ roles). A large bank retained us to build their product and digital team. Unfortunately, they went out of business in March 2023 (halfway through the engagement). #RIPFirstRepublic.

For those of you counting at home, that’s a 50% peak-to-trough drop from Q1 2022 to Q3 2023. No bueno.

I’d love to say I handled all of this with the calm demeanor of a captain steering a ship through a storm. Not exactly. While it wasn’t Titanic-level bad, there were plenty of rough patches. Luckily, I’ve been surrounded by a great team to help navigate things.

One of our values is – Don’t stop, especially when things get tough.

Most people (myself included) roll their eyes when it comes to company values. But this one held true. Our team never stopped. It has shown in our recent results. Here are some trends.

A significant acceleration in Year-over-year hiring

The largest Quarter-over-quarter improvement in 2+ years

Demand for RPOs and Multi-hire engagements

What does all of this mean for Q4? Your guess is as good as mine. We aren’t seeing any sign of things slowing down during the first two weeks of October. But October is typically a busy month for hiring.

I recently attempted to update our Q4 projections. I pulled our Q4 numbers for the past four years for a point of reference. In 2020 and 2021, Q4 was our largest quarter of the year (30% of our annual revenue). In 2022 and 2023, it was our smallest (20% of revenue).

What does it all mean?

Q4 can be great when the market is accelerating. And terrible when it is slowing down.

Insight like that is why I get paid the big bucks, I guess.

You know what would make me perfectly happy? Something in the middle…

What does that mean if you are looking to hire? There is still less competition than there was 2+ years ago. But most people don’t NEED to make a move (ie they won’t take your low ball offer).

Take advantage of it if you can. If these trends continue, it is going to get a lot more competitive in a quarter or two.

Happy hiring and check back in 3 months from now to see how things played out.

Everyone loves a good January hiring plan. You know, the kind you slap together after the holidays, between inbox cleanups and trying to stick to your New Year’s resolutions.

But if you’re serious about hiring success in 2026? You’re already behind.

In this week’s Hirewell Update, Ryan Ross and Jeff Smith break down why Q4 is the real planning season and how companies actually pulling it off are blending internal teams with RPO help to scale smart, not desperate.

Want to start strong instead of scrambling in Q1?

Watch “How to ensure hiring success in 2026” now.

Because “we’ll figure it out later” is not a strategy.